Many employer plans now offer both a traditional 401(k) plan and a Roth 401(k) option, which allows employees to contribute up to $19,500 annually ($26,000 for age 50+).

Some plans offer an attractive third option for high earners to save even more for retirement: the after-tax 401(k) plan.

With this option employees can contribute a total of up to $58,000 annually ($64,500 for age 50+).

Employers offering this opportunity

The number of companies that offer after-tax contributions to your 401(k) is growing, including Workday, Salesforce, Google, Apple, Microsoft, Nvidia, Facebook, Cisco, Verizon, FedEx, General Motors, and Boeing. You should check with your employer to see if your plan offers the after-tax option.

First, a review of traditional 401(k)s and Roth 401(k)s

Traditional 401(k)s

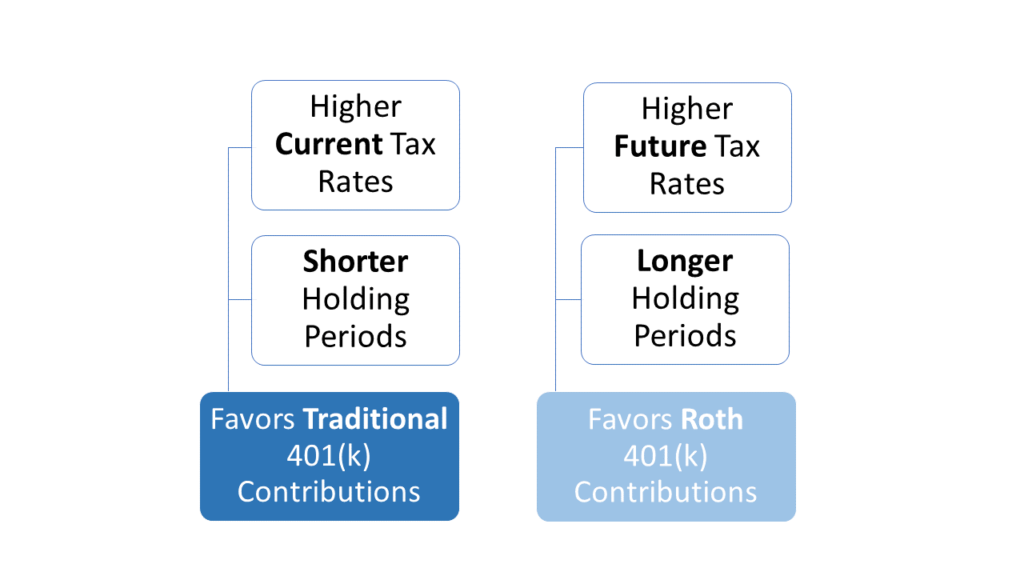

A traditional 401(k) allows an employee to elect to defer up to $19,500 of compensation before taxes in 2021 ($26,000 for age 50+). The benefit of pre-tax contributions is to reduce your taxes at the time of contribution, allowing the earnings in the plan to compound over time and deferring taxes until you withdraw funds during retirement when you may be taxed at a lower rate.

Roth 401(k)s

Elective deferrals to a Roth 401(k) are made after-tax, i.e., contributions do not reduce your taxable income/taxes at the time of contribution. Earnings also compound over time, but you will not owe tax when you withdraw funds during retirement. How to Save Even More with After-Tax 401(k) Contributions

How to Save Even More with After-Tax 401(k) Contributions

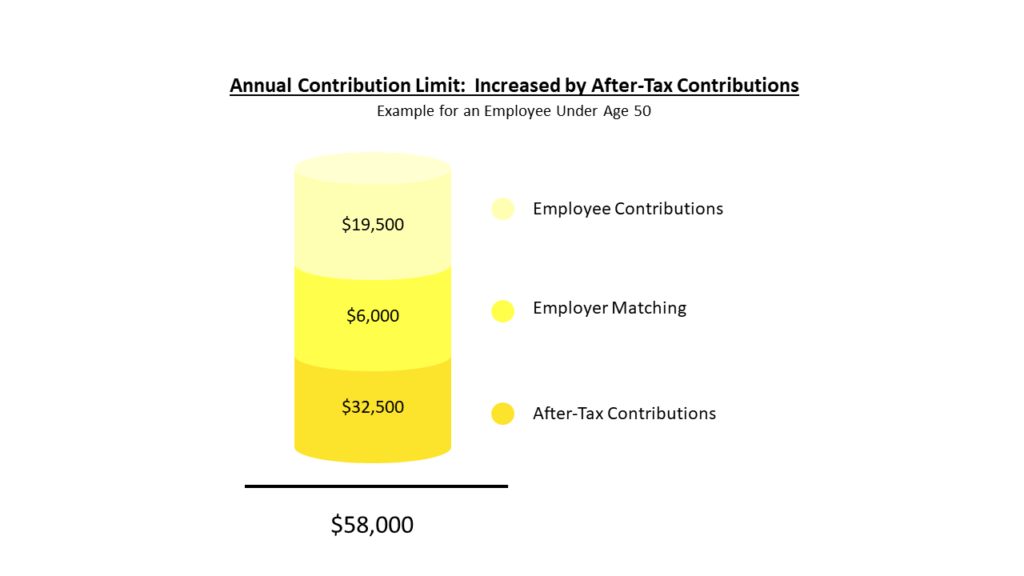

After-tax contributions have much higher contribution limits: total plan contributions are capped at the lesser of 100% of compensation or $58,000 ($64,500 for age 50+). For example, an employee under age 50 who is contributing $19,500 to a traditional 401(k) plan and receiving a $6,000 employer match could contribute an additional $32,500 of after-tax contributions to the after-tax 401(k) plan. At termination of employment, the after-tax contributions may be rolled into a Roth 401(k) or Roth IRA. The earnings on the after-tax contributions may be rolled into a traditional 401(k) or traditional IRA.

At termination of employment, the after-tax contributions may be rolled into a Roth 401(k) or Roth IRA. The earnings on the after-tax contributions may be rolled into a traditional 401(k) or traditional IRA.

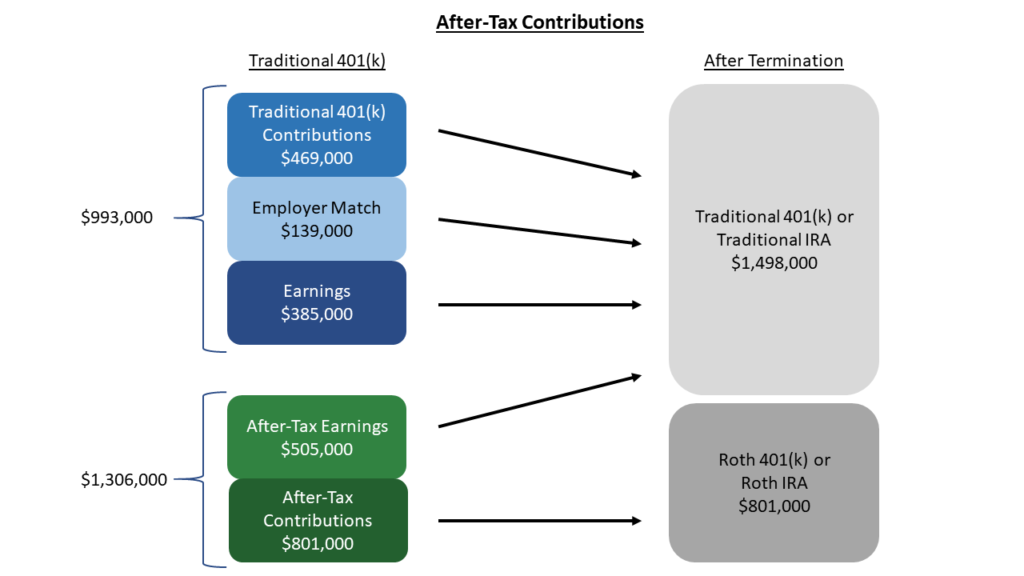

Let’s consider the example above in which an employee makes the maximum pre-tax 401(k) contributions, the employer match is $6,000 and the after-tax contribution is $32,500. Let’s also assume the employee continues making the maximum contributions each year for 20 years, and the investment return is 7% per year*.

The employee leaves the company after 20 years and rolls the after-tax contributions into a Roth 401(k) or Roth IRA and rolls the earnings on those contributions into a traditional 401(k) or traditional IRA. The value of the traditional 401(k) or traditional IRA would be $1,498,000. The after-tax contributions would be rolled into a Roth 401(k) or Roth IRA, with a value of $801,000. But it can get even better! Many employer plans now allow for immediate conversion of the after-tax contributions into the Roth 401(k) so that both the contributions AND future earnings on those contributions grow in the Roth 401(k) tax-free for your lifetime.

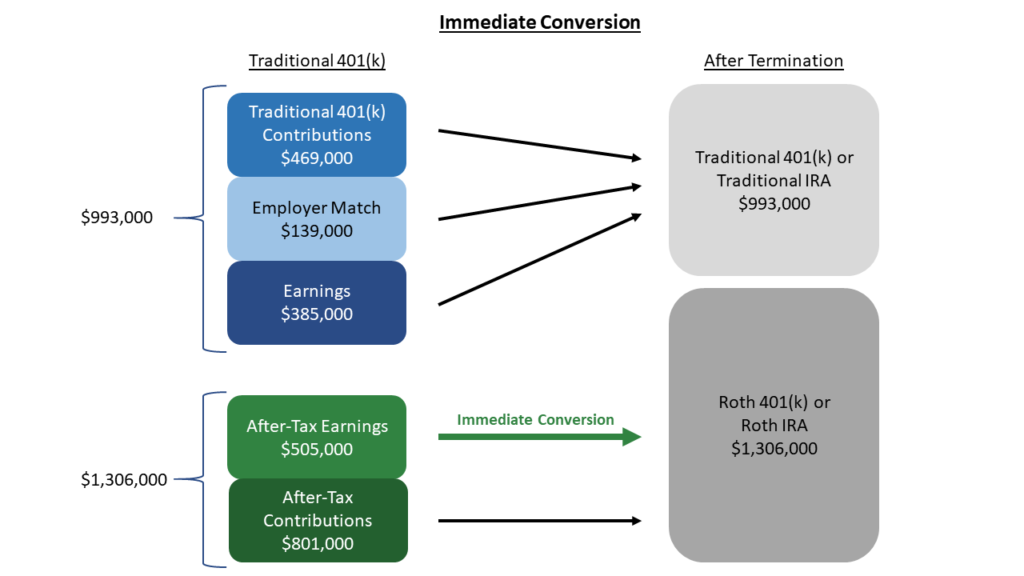

But it can get even better! Many employer plans now allow for immediate conversion of the after-tax contributions into the Roth 401(k) so that both the contributions AND future earnings on those contributions grow in the Roth 401(k) tax-free for your lifetime.

Using the same assumptions in the example above, after 20 years the value of the Roth 401(k) would be $1,306,000, consisting of $801,000 of after-tax contributions PLUS the $505,000 of earnings on those contributions. Additional Considerations

Additional Considerations

Lastly, although Roth 401(k)s have required minimum distributions at age 72, Roth IRAs do not. Rolling your Roth 401(k) into a Roth IRA at termination of employment has the added benefit of avoiding required distributions during your lifetime. If you do not need the funds, the Roth IRA can compound for your lifetime. Your non-spouse beneficiaries would not pay tax on it either, although they would need to distribute the funds within ten years after your death**.

Of course, contributing tens of thousands of dollars above your normal 401(k) contribution will impact your cash flow. Be sure to have a financial plan in place before increasing your retirement savings.

Business Owners

There are other retirement savings vehicles for business owners that allow for even larger annual contributions, which we would be happy to discuss with you.

Feel free to contact us to discuss if after-tax contributions make sense for your unique situation. Of course, retirement planning is only one piece of the puzzle of wealth management services that Parkside provides. Reach out to learn more.

*Contribution limits and matching increase each year by inflation, as allowed.

**Spousal beneficiaries can defer distributions for their entire lifetime.