We want to make our clients aware of a new tax break with a social impact dynamic that Congress passed into law last December. Over 8,000 low-income areas throughout the United States have been designated by the Federal Government as Opportunity Development Zones (ODZs) to incentivize investment in these communities by providing potential tax benefits.

The program works like this: investors who realize capital gains have 180 days to roll the proceeds into an ODZ investment through a qualified fund. The ODZ investment can delay recognition of and eventually reduce tax on the capital gains of the investor’s original investment. Additionally, capital gains produced by the ODZ investment itself could be subject to no tax depending on how long the ODZ investment is held.

In summary, the original investment and the subsequent ODZ investment are currently expected to be treated as follows:

- The gain from the original investment can be deferred until December 2026 if reinvested in a qualified ODZ fund.

- The basis of the original investment is increased by 10% after five years and an additional 5% after seven years, effectively excluding up to 15% of the original investment gain from taxation.

- Gain in the subsequent ODZ investment will receive a permanent exclusion from taxation if held for at least ten years.

A “qualified fund,” which is required to make ODZ investments, is an investment partnership or corporation organized for the sole purpose of investing in property in ODZs, with at least 90% of the investments made in ODZs. Funds may be established by individuals or small groups, and a taxpayer self-certifies to become qualified.

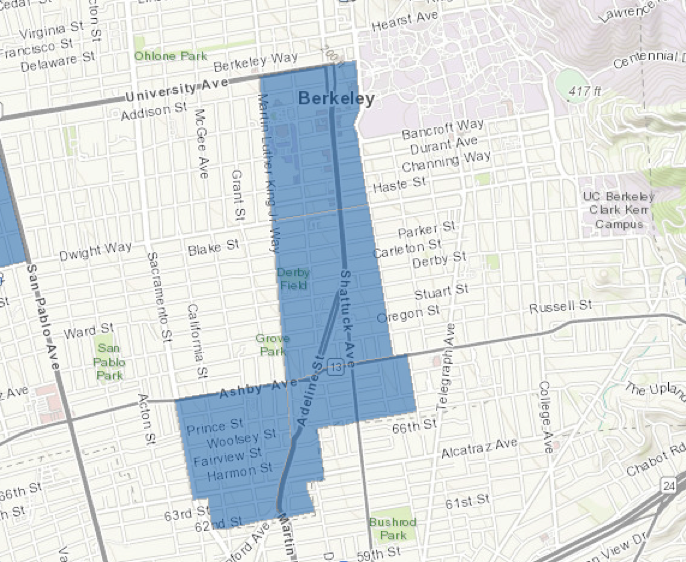

Many of our clients are interested in opportunities to expand their SRI/ESG (socially responsible or environmental, social and governance-focused) investing. Whether the ODZ program results in benefits to truly underserved markets remains to be seen and will likely be driven by the intentions of the investors in these programs. There are no requirements to spread out investments or limit concentrations in specific zones, and so cherry picking only certain zones and areas is allowed. For example, gentrifying areas of several urban centers are designated as qualified zones, including a large part of downtown Berkeley, CA:

Many details regarding the program remain undefined to date, but will be provided by the Treasury Department “shortly,” according to Steven Mnuchin, quoted in a recent Bloomberg article.

We will provide updates as more details are released by the Treasury Department and will analyze the potential financial benefits of the program when the final details become available. Key factors of the analysis will include assumed returns of an investment in an ODZ compared to other investment opportunities, the notable lack of liquidity for capital over the period required to obtain the tax benefits and the lack of historical data with which to evaluate these investment opportunities.

As always, don’t hesitate to contact Parkside Advisors with any questions.